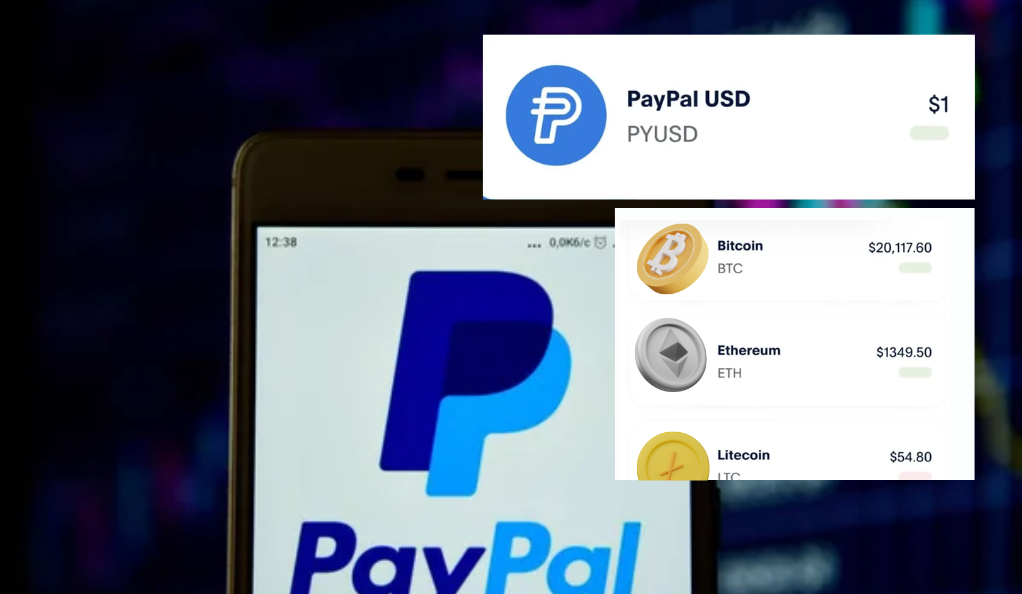

SAN JOSE, CA – In a bold move signaling its increasing commitment to the world of digital assets, PayPal announced today the launch of its own dollar-backed stablecoin. This development comes as the latest in a series of strategic steps the payment giant has taken to integrate cryptocurrency into its platform.

The new stablecoin, named “PayPal Dollar” (PPD), will be pegged 1:1 to the US dollar, ensuring its value remains stable in comparison to the volatile nature of other cryptocurrencies. PayPal has stated that for every PPD issued, there will be an equivalent US dollar held in reserve, aiming to provide users with confidence in the coin’s value and stability.

A Strategic Move

Since its initial foray into the cryptocurrency market in 2020, PayPal has been progressively expanding its crypto-related services. The introduction of the PayPal Dollar is seen by many industry experts as a strategic move to further solidify its position in the digital currency ecosystem.

“Stablecoins offer a bridge between the traditional financial system and the burgeoning world of cryptocurrencies,” said Dr. Helena Fischer, a cryptocurrency analyst at Digital Finance Institute. “With PayPal’s vast user base and trusted reputation, the PayPal Dollar has the potential to become one of the most widely used stablecoins in the market.”

Benefits for Users

The PayPal Dollar will offer users a range of benefits. Not only will it serve as a stable store of value, but it will also facilitate faster and cheaper cross-border transactions. Moreover, with PayPal’s extensive network, users can expect seamless integration of PPD into their existing PayPal accounts, enabling easy conversions between PPD, other cryptocurrencies, and fiat currencies.

Regulatory Compliance

In light of increasing regulatory scrutiny on digital assets, PayPal has emphasized its commitment to ensuring that the PayPal Dollar adheres to all relevant regulations. The company has partnered with a leading US bank to hold the dollar reserves backing PPD and will undergo regular audits to verify the 1:1 peg.

Future Prospects

As the lines between traditional finance and digital assets continue to blur, PayPal’s venture into stablecoins marks a significant step towards the mainstream adoption of cryptocurrencies. With other major financial institutions also exploring the potential of digital assets, the future of finance seems poised for a transformative shift.

PayPal’s announcement has already generated significant buzz in the financial community, and it remains to be seen how this development will shape the future landscape of digital payments and online commerce.